21+ paycheck calculator rhode island

It is not a substitute for the. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Rhode Island Hourly Payroll Calculator - RI Paycheck Calculator.

. Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Employers pay between 099 and 959 on the first 24600 in wages paid to each employee in a calendar year. This free easy to use payroll calculator will calculate your take home pay.

Rhode Island Paycheck Calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only. Back to Payroll Calculator Menu 2013 Rhode Island Paycheck Calculator - Rhode Island Payroll Calculators - Use as often as you need its free.

Payroll pay salary pay check. The tax rates vary by income level but are the same for all. Calculating your Rhode Island state income tax is similar to the steps we listed on our Federal paycheck.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. It is not a substitute for the. This Rhode Island hourly paycheck.

Rhode Island Salary Paycheck Calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022. Rhode Island has a progressive state income tax system with three tax brackets.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Forza horizon 5 tuning calculator. Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Average value over interval calculator. Take home pay is calculated based on hourly pay rates that you enter along with the pertinent Federal State and local W-4. If youre a new employer congratulations by the way you.

Overview of Rhode Island Taxes. Supports hourly salary income and multiple pay. Luteal phase length calculator.

Just enter the wages tax withholdings and other information required. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only.

Free Paycheck Calculator Hourly Salary Usa Dremployee

How To Pay Taxes On Sports Betting Winnings Bookies Com

New York Gambling Winnings Tax Calculator For October 2022

Remote Jobs Employment In Phoenix Az Indeed Com

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Employee Paycheck Calculator Worker Take Home Pay Calculator

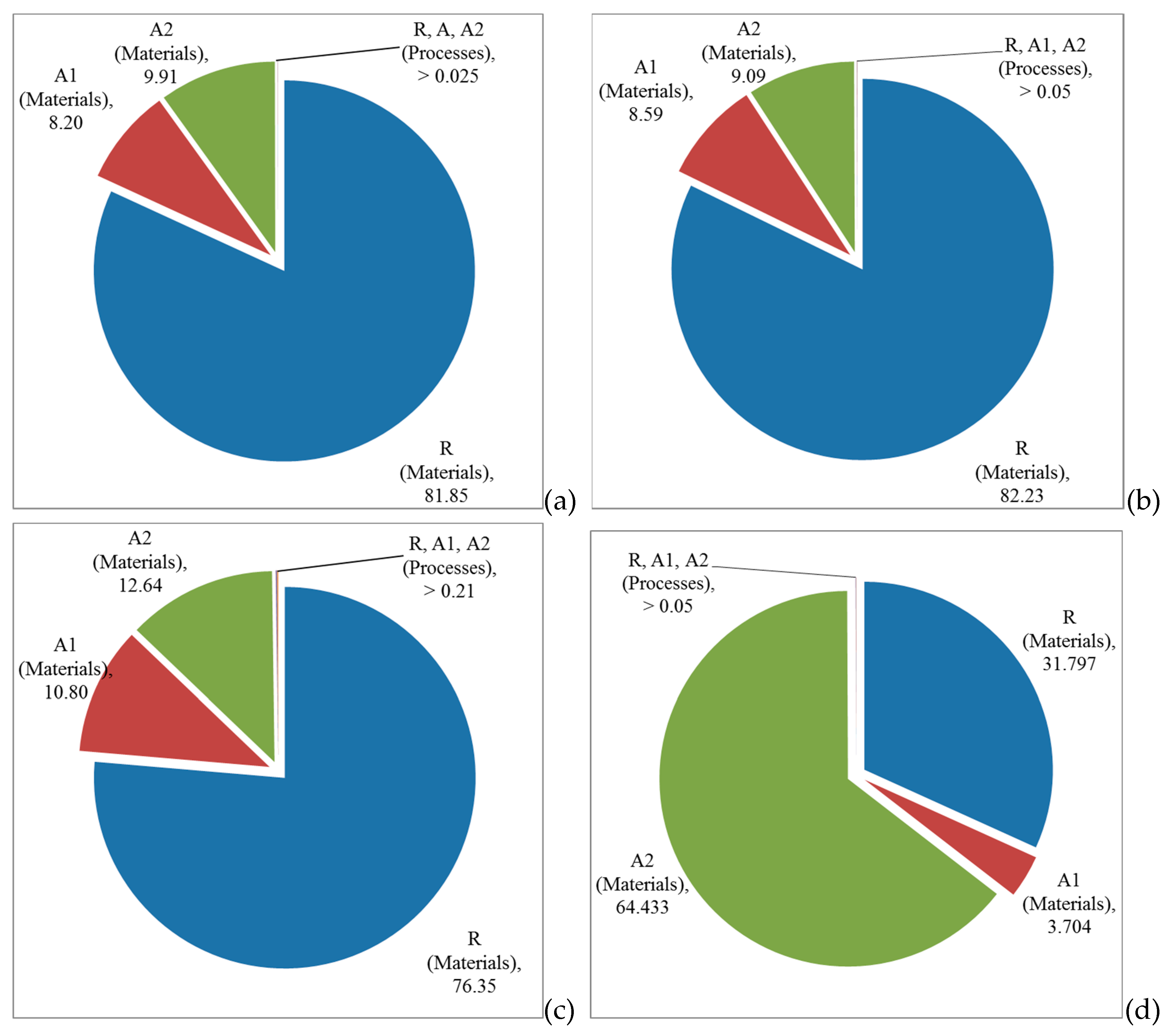

Sustainability Free Full Text Shades Of Green Life Cycle Assessment Of A Urethane Methacrylate Unsaturated Polyester Resin System For Composite Materials Html

China S 21 Free Trade Zones Guide 2021 Fdi China

Michigan Lottery Tax Calculator Comparethelotto Com

North Providence Rhode Island Ri 02904 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Is Online Sports Betting Legal In Rhode Island

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Arbitrage Calculator Free Arbitrage Betting Calculator